It’s been a crazy last couple of years. And that is probably an understatement.

And 2022 is off to a similar start with supply disruptions, surging inflation, and war overseas.

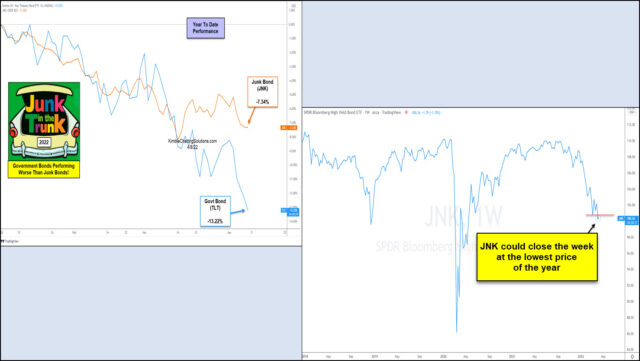

Needless to say, stocks are trading lower this year. And, no surprise, junk bonds are trading lower as well. But what is surprising is that the often safe-haven US treasury bonds (TLT) are trading down… by a lot.

Today’s chart 2-pack looks at how the junk bonds ETF (JNK) is out-performing the government bonds ETF (TLT). Not very often that you see stocks get hit and treasuries perform worse than junk bonds.

Also, you can see that junk bonds are at an important intersection after closing last week at the lowest price of the year. Bulls better hope for a quick recovery or we could see some mean reversion as junk bonds head lower. Stay tuned!

This article was first written for See It Markets.com. To see the original post CLICK HERE.