The financial markets have been volatile this year, to say the least. And much of the volatility has been tied to inflationary concerns and rising interest rates via the Federal Reserve.

That said, we’ve come to a point in time where it appears that inflation may be easing. And that should be music to the ears of everyday consumers.

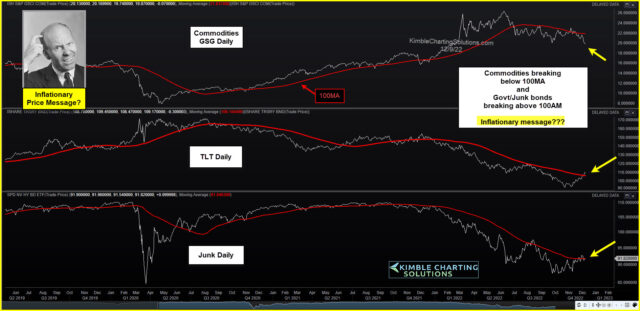

Today, we share a chart highlighting the price of commodities versus bonds to underscore the potential for lower prices going forward.

As you can see, the price of commodities (DBC) is dropping and recently broke below its 100 day moving average. At the same time, government bonds and junk bonds are moving higher and breaking above the 100 day moving average.

Taken together, it appears that inflation is chilling here. And, if so, this could be a boon for consumers. Stay tuned!

This article was first written for See It Markets.com. To see the original post CLICK HERE.