The price of gold is trading just off its all-time highs while the price of silver is lagging. Together, they haven’t quite provided mining equities the boost they need to out-perform the broad market.

But an 11-year cycle may be saying that gold and silver mining stocks are ready to rise again.

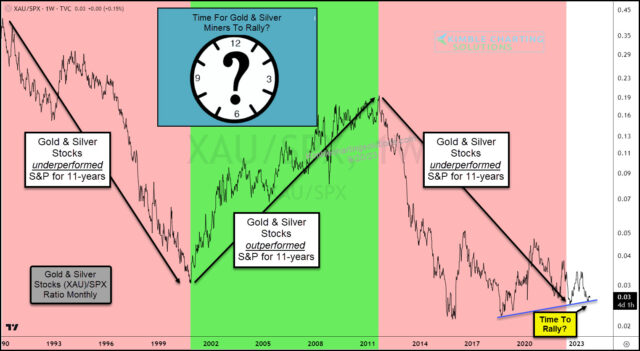

Today, we take a look at the performance of the Gold and Silver Miners Index (XAU) versus the S&P 500 Index by charting its performance ratio since 1990. The ratio is comprised of the $XAU Precious Metals Index / $SPX S&P 500 Index.

As you can see, since 1990 the ratio appears to be working on 11 year trends/cycles.

The latest cycle of underperformance has come to an end and the ratio is trying to hold near-term support.

Time for $XAU and gold and silver mining stocks to start outperforming again? Stay tuned!

This article was first written for See It Markets.com. To see the original post, CLICK HERE.