It’s been a tough environment for the Utilities Sector.

The ETF (XLU) has underperformed for months and really stunk it up in recent weeks.

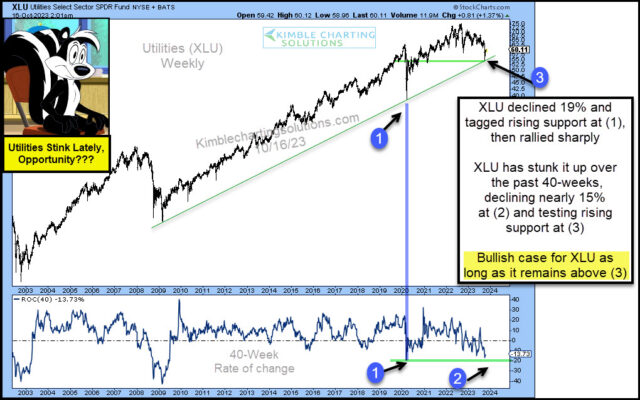

Looking at the chart below, you can see that XLU declined 19% in 2020, tagging its uptrend line at (1) before rallying sharply. Fast forward to today and we can see that XLU decline nearly 15% at (2) while testing its rising trend line and lateral support at (3).

The decline looks to be a bullish setup as long as XLU stays above support at (3). Are stinky Utilities ready to reverse higher?

If Utilities break through support on the downside,

$XLU sends a negative message to S&P 500!

This article was first written for See It Markets.com. To see the original post CLICK HERE.