by Chris Kimble | Mar 31, 2022 | Kimble Charting

Over the past 11 years, the Australian Dollar has been in a downtrend. Today’s chart highlights its falling channel marked by each (1). Could we be nearing a change in trend? Everything changed after the covid bottom in 2022. Since then, the Australian Dollar ($AU)...

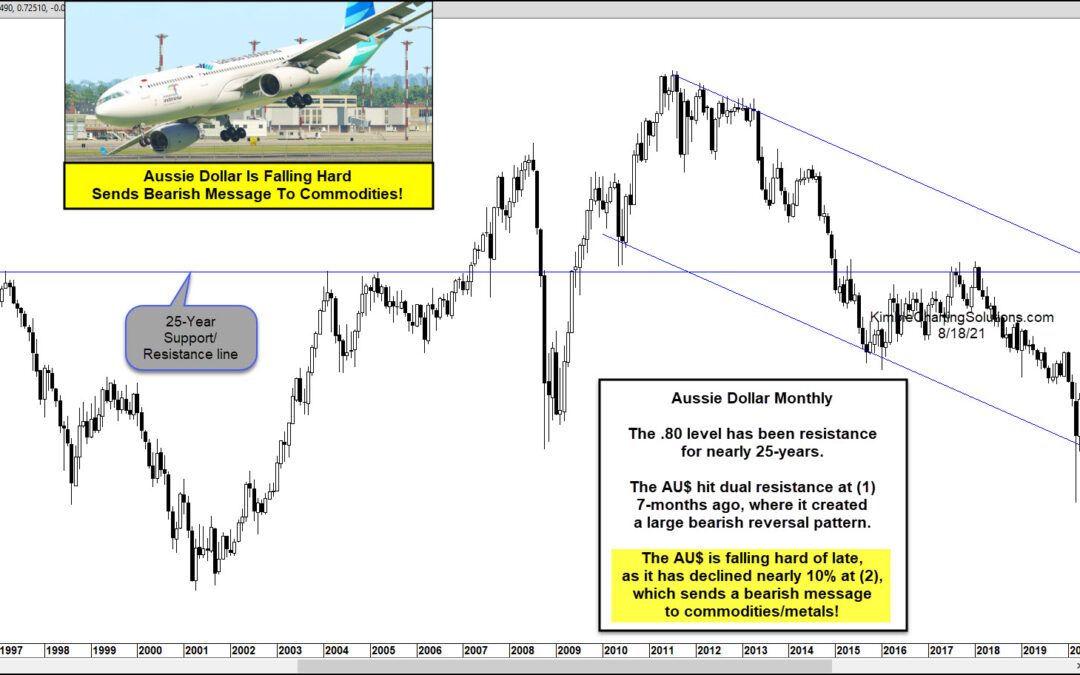

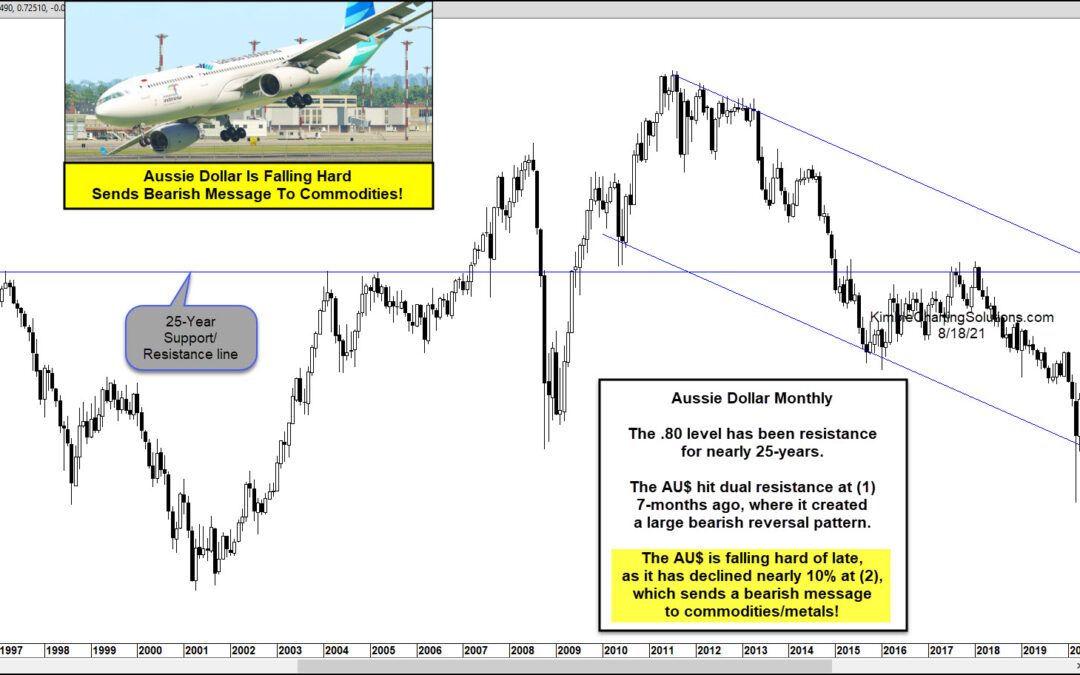

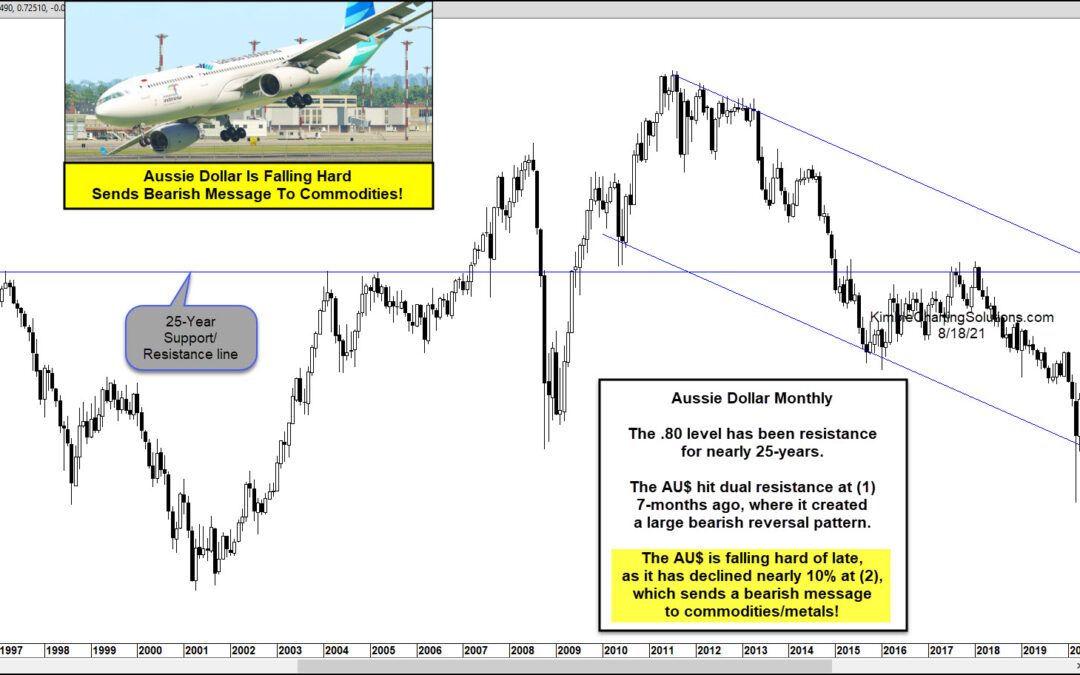

by Chris Kimble | Aug 19, 2021 | Kimble Charting

When the Australian Dollar “moves”, so do commodities. And this time the Australian Dollar “aussie” could be sending a bearish message to commodities. Today’s chart looks at the Aussie Dollar on a “monthly” basis. As you can see, the Aussie Dollar has fallen hard of...