by Chris Kimble | May 19, 2022 | Kimble Charting

Higher commodity prices have seeped into everyday costs (food and energy), and at the same time, interest rates have also been rising. That’s a bad combination for everyday America. But perhaps there is some relief on the horizon… at least in the form of lower...

by Chris Kimble | May 3, 2022 | Kimble Charting

Commodities have been an important theme within the financial markets and economy for several months. The price rally has ushered in inflationary winds not seen in 4 decades. But the rally has slowed to a consolidation… and in some commodities a turn lower. While it...

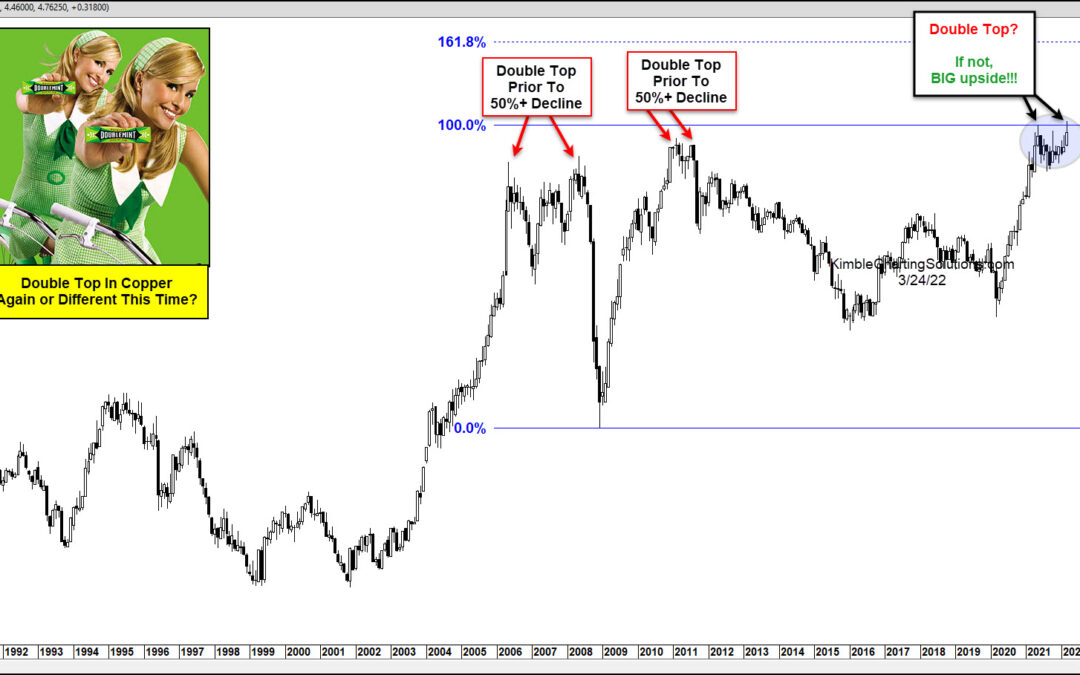

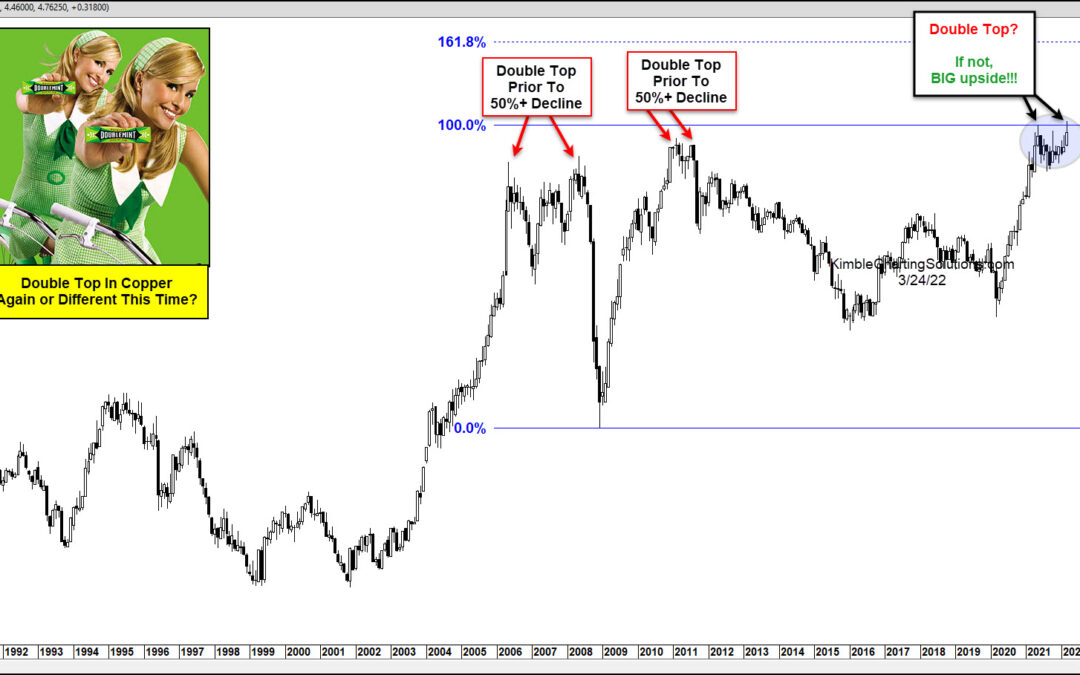

by Chris Kimble | Mar 25, 2022 | Kimble Charting

Copper is among several commodities with elevated prices right now. It has also formed an important price pattern that may send one of the strongest macro messages in years. Today, we look at a long-term “monthly” chart of Copper. As you can see, in the months/years...

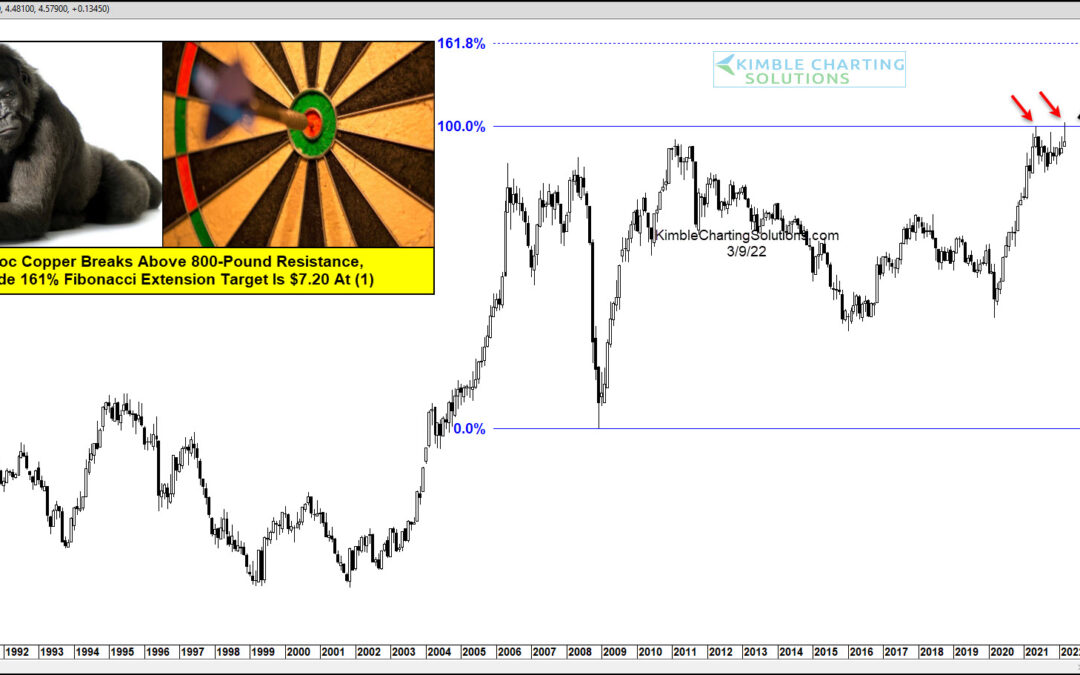

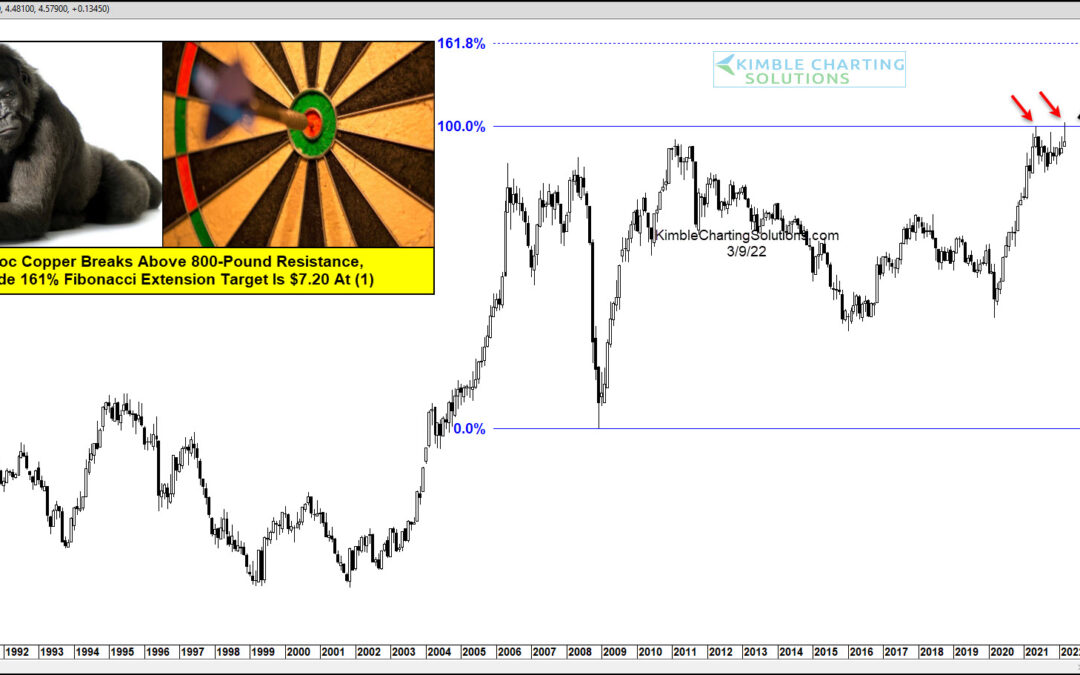

by Chris Kimble | Mar 10, 2022 | Kimble Charting

Copper prices have been running hot ever since the onset of COVID. Sound familiar? Yep, because it’s happened across several commodities. Things are rough right now on the inflation front… but could it get worse before it gets better? Today we look at the long-term...

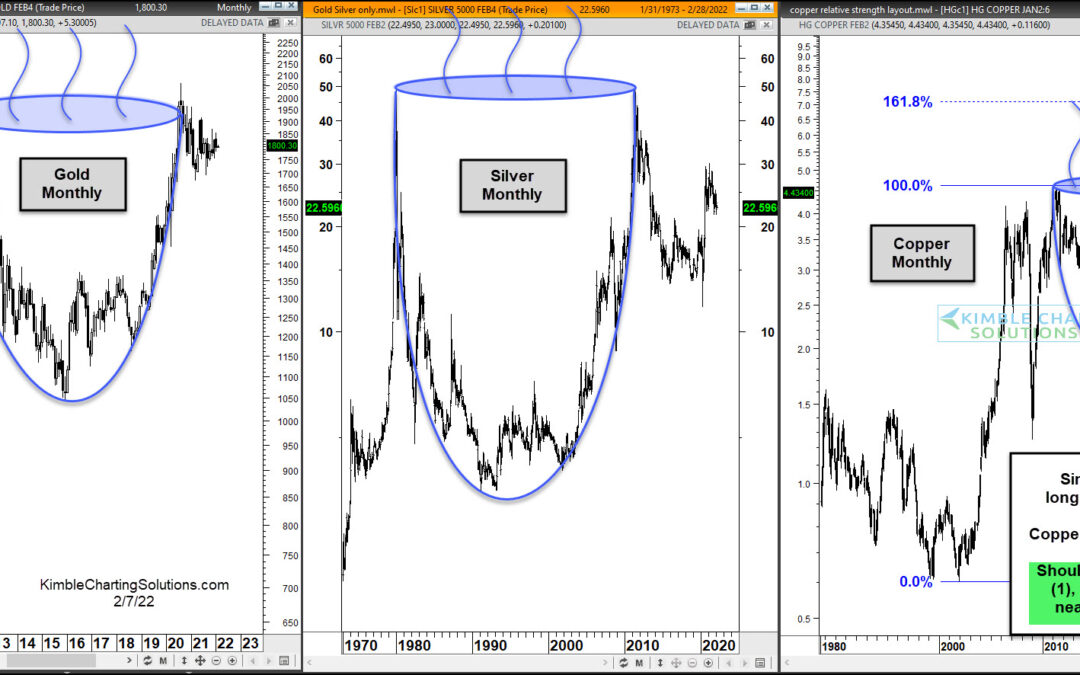

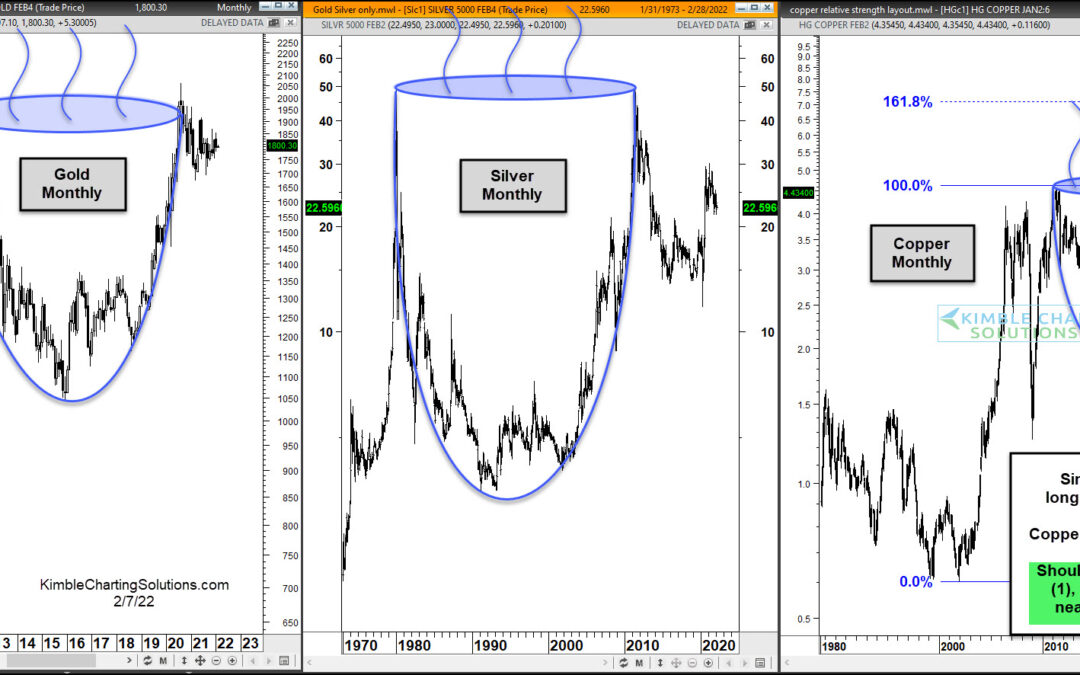

by Chris Kimble | Feb 8, 2022 | Kimble Charting

Each investor has to be aware of what their time-frame is. Are we looking at the coming days, weeks, months, or years. Some are traders and some are more active than others. Timeframes are particularly important right now for precious metals. Especially over the...

by Chris Kimble | Sep 20, 2021 | Kimble Charting

When Doc Copper speaks, investors should listen. And it may be that time again. The price of copper broke above the $4 mark early this year… but it’s struggled to maintain its momentum and is in a multi-month pullback. Today’s chart is a “weekly” chart of Copper. And...

by Chris Kimble | Jul 28, 2021 | Kimble Charting

Just as the economic recovery is picking up steam, there are mixed messages coming from inflation data as well as the equities (breadth) and bonds markets (yields). Enter the commodities market… here we can find several key economic inputs that are elevated, and some...

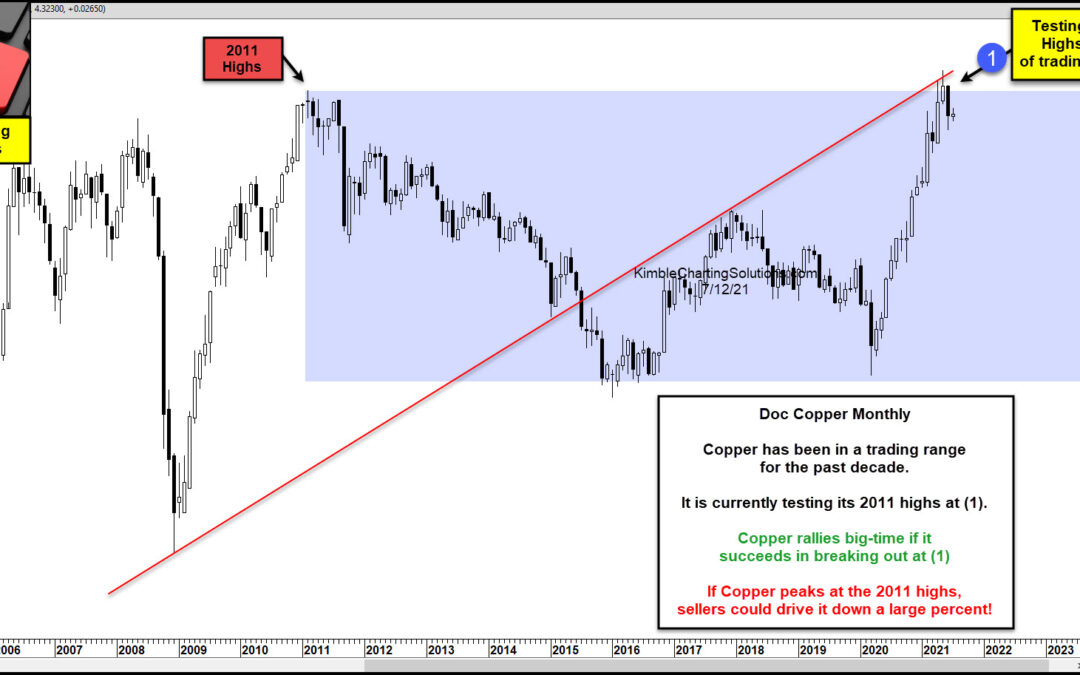

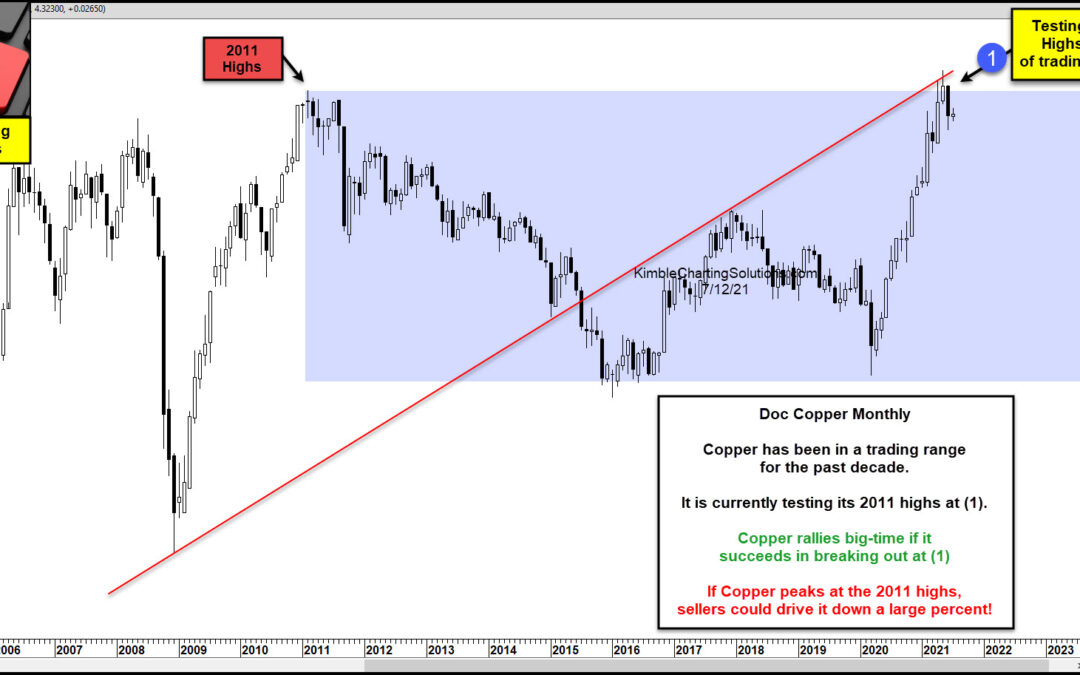

by Chris Kimble | Jul 14, 2021 | Kimble Charting

The price of Copper continues to be an indicator for the economic recovery, as well as emerging inflationary concerns. We’ve seen Copper prices rip higher over the past several months (similar to 2009/2010). On one hand, this is signaling (and underscoring) the...