CLICK ON CHART TO ENLARGE

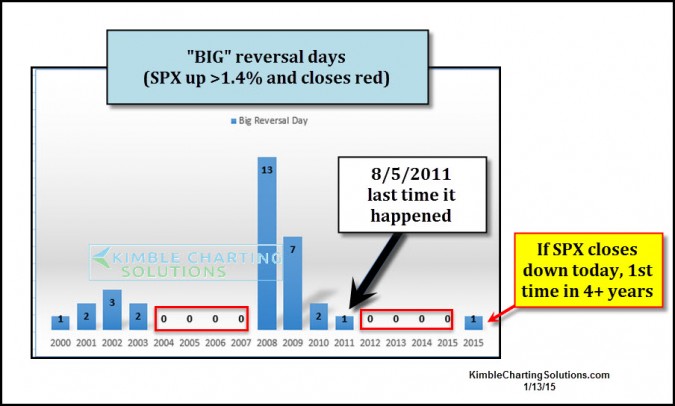

Today could be a first “Big Reversal Day” day in almost 4 years!

If the SPX closes down today, it will be the first “Big Reversal” (day when the SPX was up 1.4%+ and closes down on the day).

I shared with John Melloy of CNBC that an unusual number of “Doji Star” reversal patterns took place at the end of the year. See John’s CNBC Pro article (HERE) More of them in a cluster than I have seen in the past 35 years.

The patterns have not proven a thing so far, other than the potential that key trend reversals could be in the cards.

Today’s potential Big Reversal day (if the SPX closes down) become a little more important. The Power of the Patterns suggested that Global Dashboards and Shoe Box members, as of two weeks ago, to become the most defensive they’ve been in the past couple of years with slow money assets.

This is a big bearish wick today friends….don’t overlook what the message could be up here!

–

–

Thx for the comment and viewership Jerry

The study was about “single day reversal” patterns (SPX up more than 1.4% and closing down on the day) and when they took place in the big picture

None took place for 4-years (2004 to 2007) then look what happened.

Now we’ve had another stretch of 4-years without this type of pattern.

Just attempting to share clues to the bigger picture.

Thx again, Chris

Ethan, great question

Look at the last line of the yield post per bond strategy. “yields are testing a cluster of support, if broken, investors are out of the trade!”

How do we manage this message with the preivious post that suggests yield at reversal point?

Dear Mr. Kimble

With all due respect, I see it as a BULLISH signal….

I think now is the time to BUY!!!!!!!

Warm Regards

I don’t see the 8-5-2011 day as being a reversal. The market bottomed that week and ranged sideways for a couple months. You got it wrong, sir.