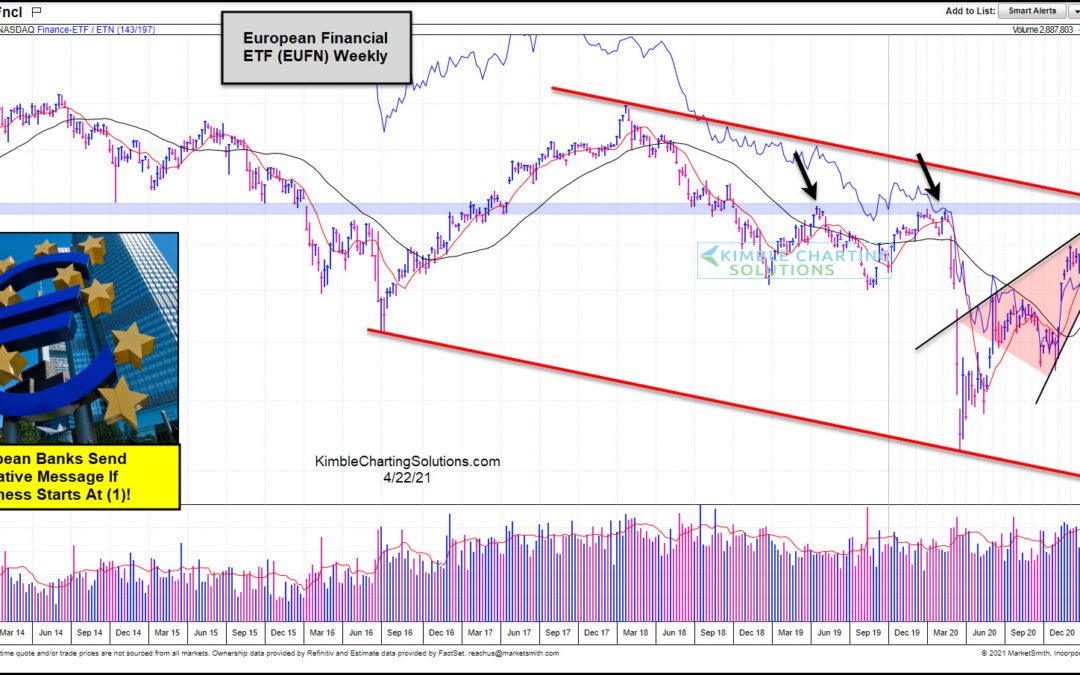

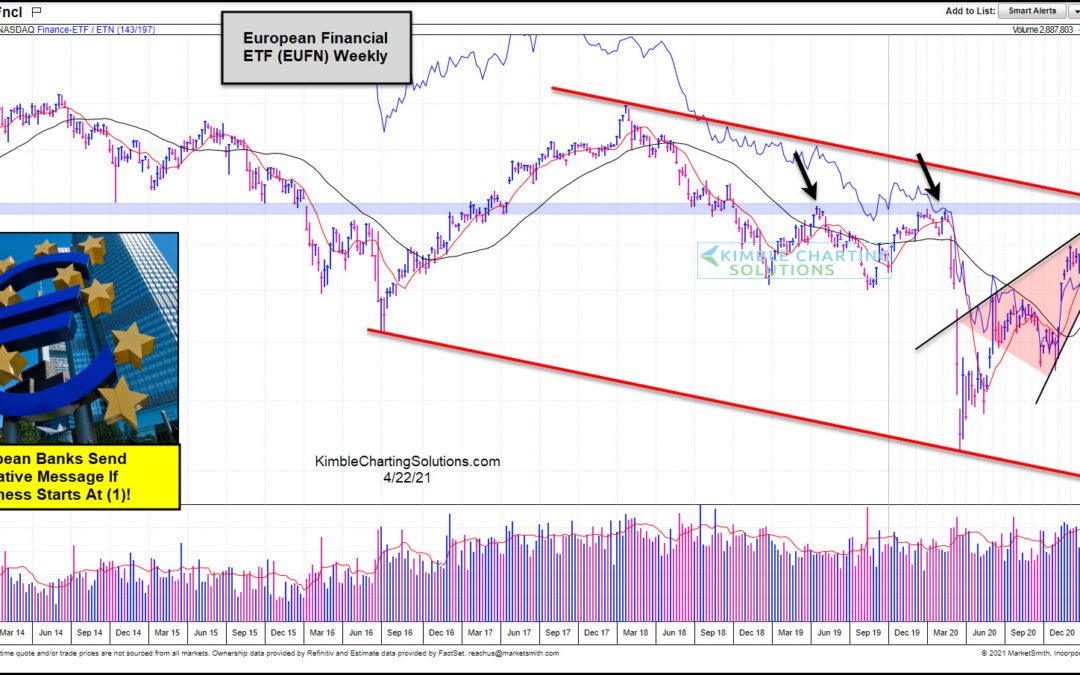

by Chris Kimble | Apr 23, 2021 | Global Dashboard, Kimble Charting

Banks and financial stocks are at the heart of every economy and play an important role in bull markets. While they may stumble or lag the broader stock market, they are always on the radar of macro investors. A breakout or steady up-trend (on any time frame) is a...

by Chris Kimble | Jan 15, 2016 | Global Dashboard, Kimble Charting

CLICK ON CHART TO ENLARGE We have been sharing the above chart with our Premium, Global Dashboard and Sector members, for the past few months. This chart looks at the Japanese Yen over the past 35-years. In 2007, the Yen took off and stocks around the world tanked....

by Chris Kimble | Oct 29, 2015 | Global Dashboard, Kimble Charting

CLICK ON CHART TO ENLARGE Yesterday we conducted a webinar for our membership, in which we shared several positive stock seasonal studies. These studies reflected seasonal stock market strength takes place between now and the end of April next year. Historically it...

by Chris Kimble | Oct 14, 2015 | Global Dashboard, Kimble Charting

CLICK ON CHART TO ENLARGE The Dow formed what looks like a long-term “Megaphone” pattern in the late late 1960’s to early 1980’s. When it took out overhead resistance of the megaphone pattern in the mid 1980’s, it pretty much never looked...

by Chris Kimble | Oct 1, 2015 | Global Dashboard, Kimble Charting, Sector / Commodity

CLICK ON CHART TO ENLARGE We often receive requests for information about our Premium Program and we are deeply humbled and honored by them! Above illustrates what Premium Members receive, ranging from personal contact with me, to daily Power of the Pattern...

by Chris Kimble | Sep 28, 2015 | Global Dashboard, Kimble Charting

CLICK ON CHART TO ENLARGE The Nasdaq 100 index has remained inside of this rising channel for the past 5-years. The herd continues to buy the dip along support of this rising channel. Last week the NDX 100 close a couple of percent lower on the week and it closed very...

by Chris Kimble | Sep 14, 2015 | Global Dashboard, Kimble Charting

For the bull market to keep running higher, it could well depend on what the Dax does at the 9,770 level! The 3-pack below looks at Germany, London and France. CLICK ON CHART TO ENLARGE This 3-pack looks at the DAX, FTSE 100 and the CAC 40 over the past 20-years. As...

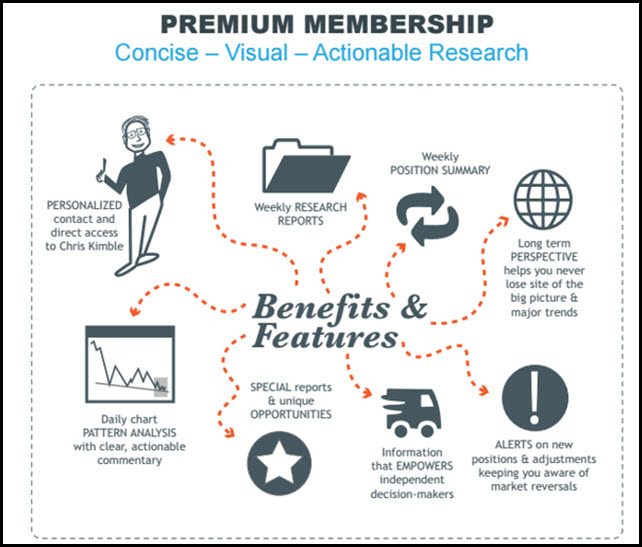

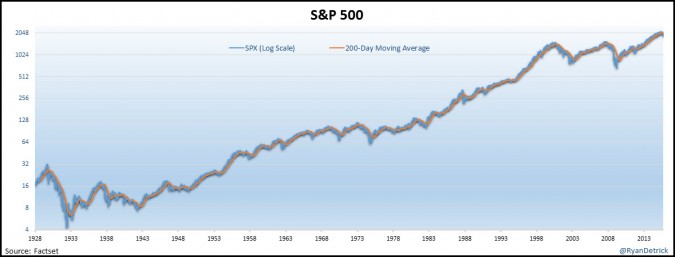

by Chris Kimble | Sep 9, 2015 | Global Dashboard, Kimble Charting

Today’s post is from my good friend Ryan Detrick. He had some unique thoughts and stats on the 200-day moving average, Thank You Ryan for your contributions! We hear a lot about the S&P 500 and its 200-day moving average. It is trading above or below...