by Chris Kimble | Feb 26, 2016 | Kimble Charting, Sector / Commodity

CLICK ON CHART TO ENLARGE Benjamin Graham is considered to be the father of value investing and Warren Buffett has been one of his students for decades. Graham shared ; “The investor’s chief problem-even his worst enemy- is likely to be himself!” How can one reduce...

by Chris Kimble | Nov 3, 2015 | Kimble Charting, Sector / Commodity

CLICK ON CHART TO ENLARGE We are all aware that Crude Oil has been hit hard over the past year. I suspect that many are enjoying part of the decline, as its driven gas prices to levels that are nice to see at the pump. Now we all have extra money to spend on the...

by Chris Kimble | Oct 1, 2015 | Global Dashboard, Kimble Charting, Sector / Commodity

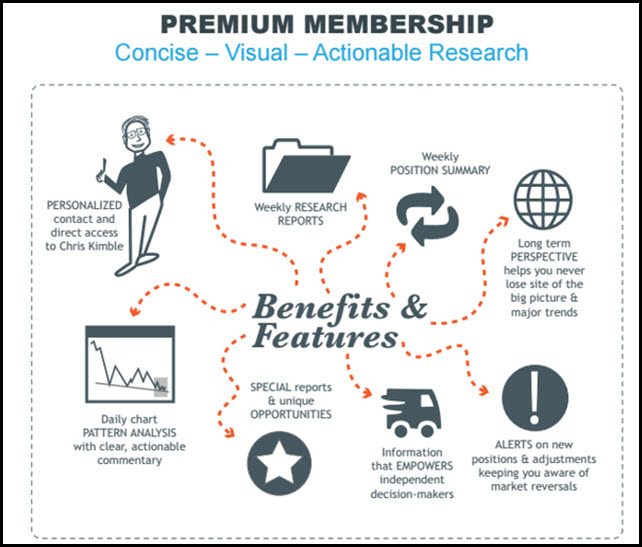

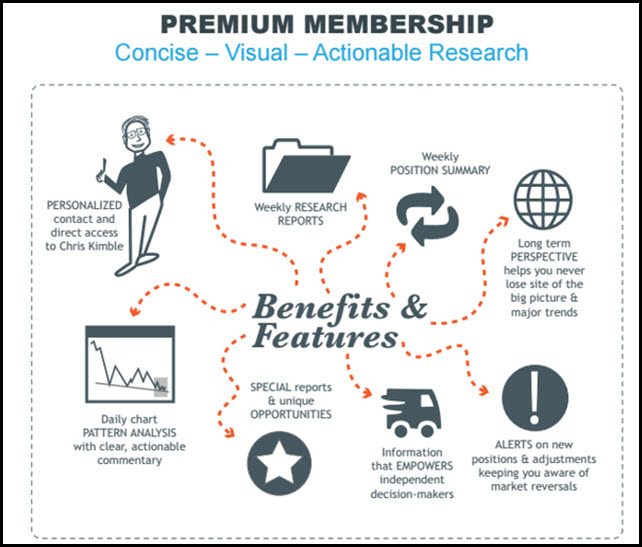

CLICK ON CHART TO ENLARGE We often receive requests for information about our Premium Program and we are deeply humbled and honored by them! Above illustrates what Premium Members receive, ranging from personal contact with me, to daily Power of the Pattern...

by Chris Kimble | Sep 17, 2015 | Kimble Charting, Sector / Commodity

For some reason, many around the world might be watching interest rates a little closer today, due to the Fed announcement this afternoon. Regardless of what the Fed does this afternoon, how do you make decisions in regards to rates and bond prices. Should you base...

by Chris Kimble | Aug 11, 2015 | Kimble Charting, Sector / Commodity

CLICK ON CHART TO ENLARGE Barron’s has been bullish equities for a good while and they have been on track with this call! Now they are suggesting to “Buy Commodities.” Are they on track again? The chart above looks at the Thompson/Reuters Commodity...

by Chris Kimble | Jun 26, 2015 | Kimble Charting, Sector / Commodity

CLICK ON CHART TO ENLARGE The chart above looks at Corn over the past 30-years and applies a 2-year rate of change to it. Over the past two years, Corn is down around 45%, been a rough go of it for sure! Could that lead to future opportunities? Below looks at the best...

by Chris Kimble | Mar 20, 2015 | Kimble Charting, Sector / Commodity

CLICK ON CHART TO ENLARGE Each week we share our favorite Patterns in the 9-key sectors of the S&P 500. We look at them from two different angles; what sectors are breaking out, and what sectors are out of favor and creating a pattern where a reversal could take...

by Chris Kimble | Mar 2, 2015 | Kimble Charting, Sector / Commodity

CLICK ON CHART TO ENLARGE Above are markets that are starting this month at all-time highs. Only the Nikkei is not at an all-time high, it did finish last month at a new monthly high, surpassing the highs hit in 2007. Historically, having numerous markets closing at...