by Chris Kimble | Feb 5, 2024 | Kimble Charting

During the COVID pandemic, commodity prices soared. And this lead to a bout of inflation that we hadn’t seen in years. But commodity prices have leveled off and this has helped to keep inflation in check. This consolidation like pattern can be see on today’s “monthly”...

by Chris Kimble | May 11, 2023 | Kimble Charting

Market prices absorb all the information that’s out there. Perhaps that’s why several commodity prices surged in the months leading up to the Russian invasion of Ukraine. And since then, they have come back down to earth. I don’t think this is exactly how Putin...

by Chris Kimble | Mar 10, 2023 | Kimble Charting

While inflation continues to dominate the news headlines (and consumer concerns), I think it’s important to highlight an interesting development in the commodities complex. And a potentially positive development! Today we take a look at a long-term “monthly”...

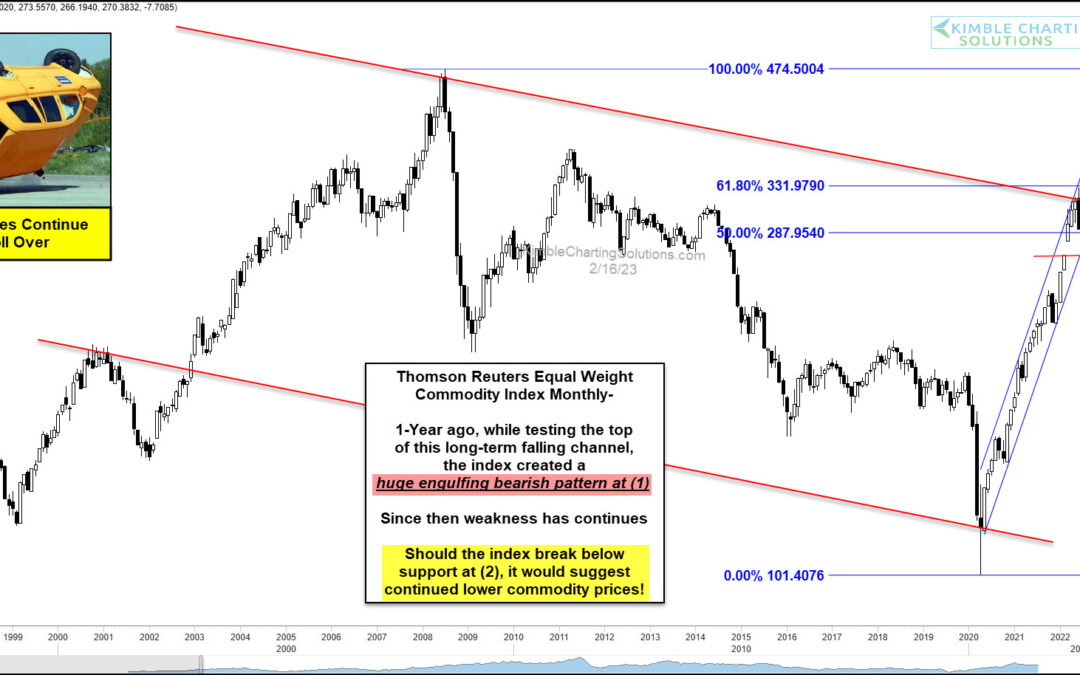

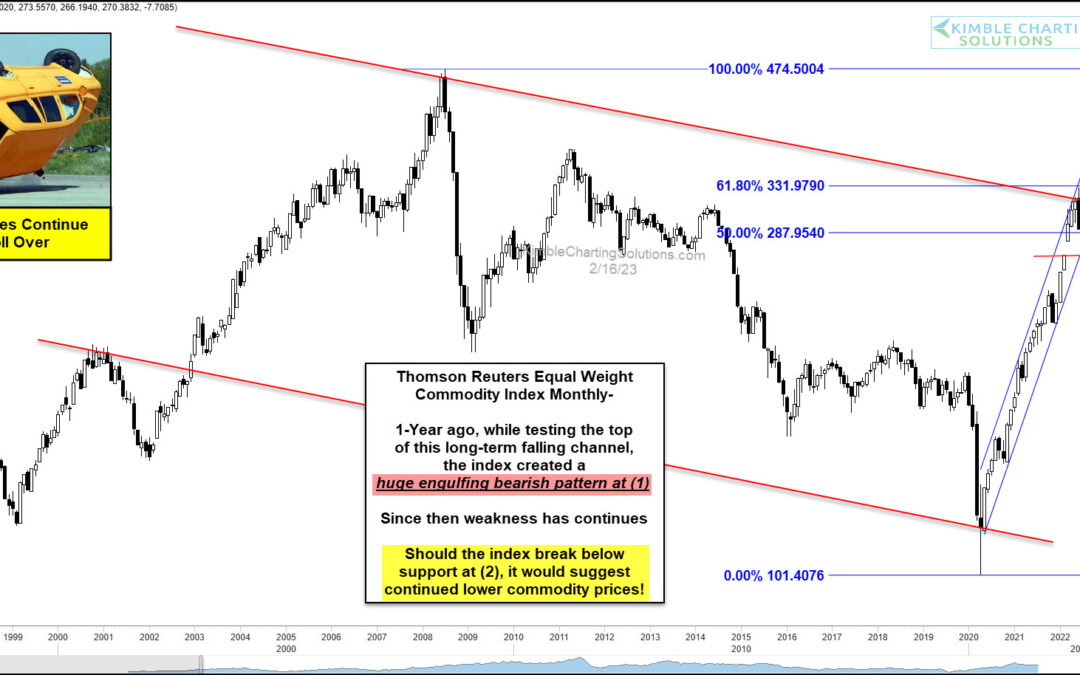

by Chris Kimble | Feb 17, 2023 | Kimble Charting

Commodity prices have skyrocketed over the past few years, but today we put the move higher into perspective. And we do this by looking at a long-term “monthly” chart of the Thomson Reuters Equal Weight Commodity Index. As you can see, commodities have been trading...

by Chris Kimble | Aug 12, 2022 | Kimble Charting

It’s fair to say that inflation has been one of the key economic buzzwords of 2022 (along with interest rates). Will the Federal Reserve’s last two big rate hikes help? Will the latest government inflation bill matter? Perhaps. But one key ingredient may have peaked a...

by Chris Kimble | Jun 23, 2022 | Kimble Charting

We have covered the commodities rally and highlighted the everyday concerns with rising inflation and rising interest rates. Today, we’ll revisit some long-term charts of key commodities and discuss why we should be watching for potential topping formations. Below is...

by Chris Kimble | May 12, 2022 | Kimble Charting

Commodities have been one of the few winners in 2022. But with elevated commodity prices, consumers are now left with an ugly dose of inflation on everyday costs (food, energy)… And with falling stock prices, they are getting a dose of deflation in their investment...

by Chris Kimble | Feb 25, 2022 | Kimble Charting

The CRB Commodity Index has rallied sharply over the past 2 years. And although the index is not near all-time highs, it is getting stretched into overbought extremes. One way to look at whether a security is trading near extreme levels is to check on its % above the...