by Chris Kimble | Mar 24, 2023 | Kimble Charting

The financial sector is the focal point of the global economy. So it’s no wonder that investors pay close attention to its performance within the stock market. And this is especially true when recession fears rise due to lackluster economic growth. Kinda sounds like...

by Chris Kimble | Sep 14, 2020 | Kimble Charting

The saying “So Goes The Banks, So Goes The Broad Market” is about to experience a big-time test! This chart looks at the Bank Index (BKX) on a monthly basis over the past 8-years. Since 2015 the 78 price zone, reflected by line (1), has been tested as...

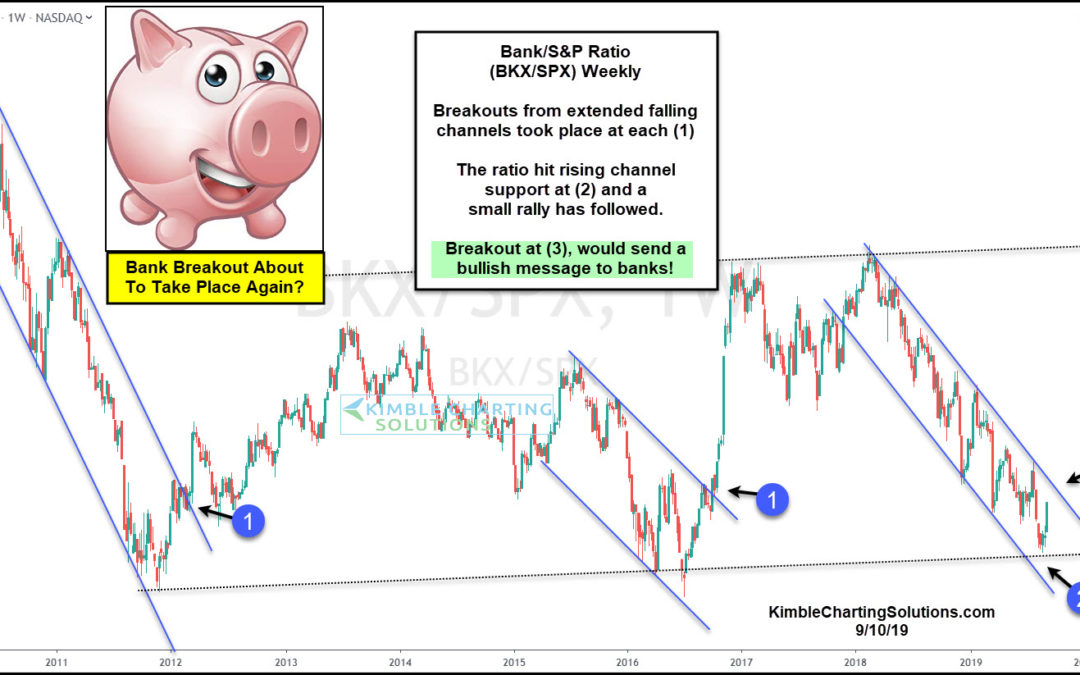

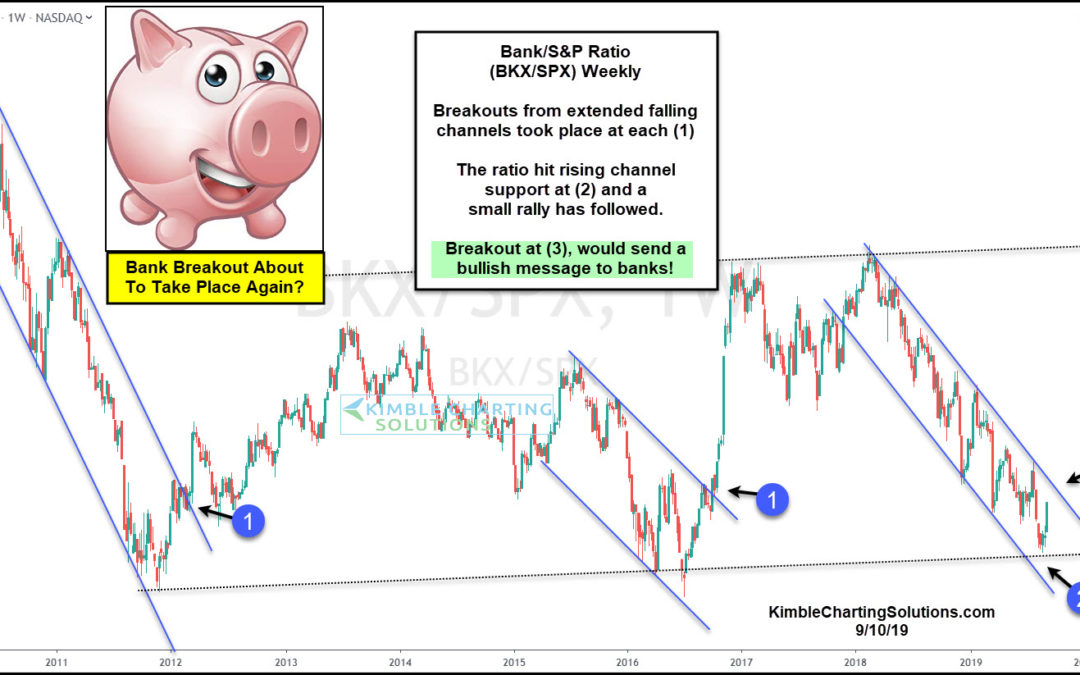

by Chris Kimble | Sep 10, 2019 | Kimble Charting

The Bank Index BKX has been trading in a downtrend since early 2018. And it has been underperforming the broad stock market indices as well. Is the bad news for banks stocks about to end? Stock market bulls sure hope so, as the stock market tends to be on stronger...

by Chris Kimble | Jul 12, 2017 | Kimble Charting

Over the past several weeks, select cyclical sectors have started to perk up. From Industrials to Transports to Financials to Materials, all have seen strength. This is good news for investors, as this could signal a fresh leg higher for stocks. Today, I’d like to...

by Chris Kimble | Apr 21, 2017 | Kimble Charting

Regional and Large banks have done well since the election. Of late they have lagged the broad market and find themselves testing what could be very important support levels. Below looks at regional bank ETF (KRE). CLICK ON CHART TO ENLARGE KRE has experienced a rally...

by Chris Kimble | Nov 22, 2016 | Kimble Charting

Rate sensitive assets have experienced rare moves since July. Government bonds (TLT), Utilities (XLU) and Real Estate (IYR) have fallen hard, as interest rates have risen of sharply. Have rates hit a peak or are they just getting started, on a much greater move much...

by Chris Kimble | Sep 19, 2016 | Kimble Charting

Banks in the states and around the world remain an important influence to the broad markets. Below looks at the patterns of banks in Europe (EUFN) and Italy (EWI) and why they are at one of the most important price points in years! CLICK ON CHART TO ENLARGE When EUFN...

by Chris Kimble | Jun 6, 2016 | Uncategorized

CLICK ON CHART TO ENLARGE The S&P 500 is just a couple of percent away from testing all-time highs. Historically quality broad market gains in the S&P took place, when Banks went along for the upside ride. Since last July, financials have headed lower and the...