by Chris Kimble | Aug 20, 2014 | Kimble Charting

CLICK ON CHART TO ENLARGE The GDXJ/GDX ratio may have created a bullish inverse head & shoulders pattern over the past year. Of late the ratio could be forming a bullish falling wedge. Two thirds of the time this pattern leads to higher prices. If the ratio...

by Chris Kimble | Jul 22, 2014 | Kimble Charting

CLICK ON CHART TO ENLARGE The above chart compares the New York Stock Exchange Index (NYSE) to the Junior Miners ETF (GDXJ). The ratio has created a strong move up over the past few years, as the stock market has performed tons better than the miners ETF. The...

by Chris Kimble | Jul 16, 2014 | Kimble Charting

CLICK ON CHART TO ENLARGE The above chart is the Silver/Gold ratio. Strong rallies in both metals often take place when this ratio breaks above key falling resistance over the past 15-years. At this time the ratio remains inside of a three year falling channel....

by Chris Kimble | Jul 9, 2014 | Kimble Charting

CLICK ON CHART TO ENLARGE A major shift in the Gold Bugs/SPY ratio could be taking place! The Gold Bugs/SPY ratio has fallen on hard times as stocks have outperformed the Gold bugs index over the past few years by a wide margin, pushing this index down a...

by Chris Kimble | Jul 2, 2014 | Kimble Charting

CLICK ON CHART TO ENLARGE This ratio compares the NYSE Composite Index to the Junior miners ETF (GDXJ). When the ratio is moving higher the NYSE is reflecting relative strength to the small mining stocks. Over the last year the ratio has stayed with a uniform...

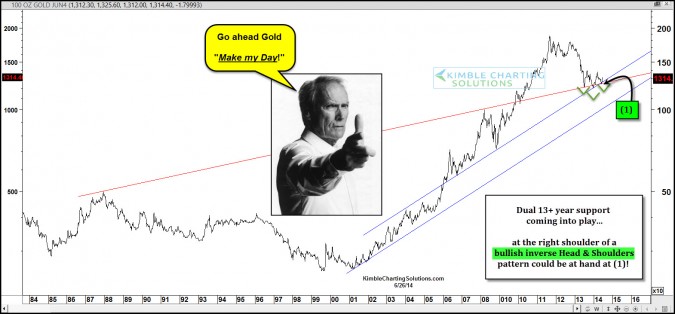

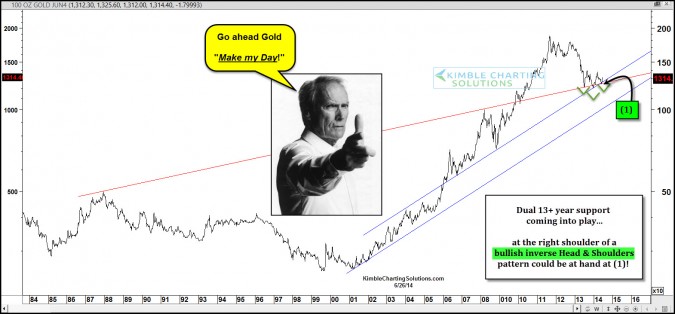

by Chris Kimble | Jun 26, 2014 | Kimble Charting

CLICK ON CHART TO ENLARGE Clint Eastwood made the phrase “make my day” popular. If this pattern read is correct, it could make the day, week and year for investors bullish Gold! Gold’s decline over the past three years had it testing dual...

by Chris Kimble | Jun 18, 2014 | Kimble Charting

CLICK ON CHART TO ENLARGE Since March I have been sharing with members that miners looked to be creating a bullish inverse head & shoulders pattern and that the right shoulder needed to be completed. Premium & Metals Members that are aggressive...

by Chris Kimble | Jun 6, 2014 | Kimble Charting

CLICK ON CHART TO ENLARGE Are Gold & Silver still in a bull market? Some say yes, others say no, each person coming from a different point of view. If one uses long-term support lines (10 years+) as a gauge, the bull markets are still in place in both...