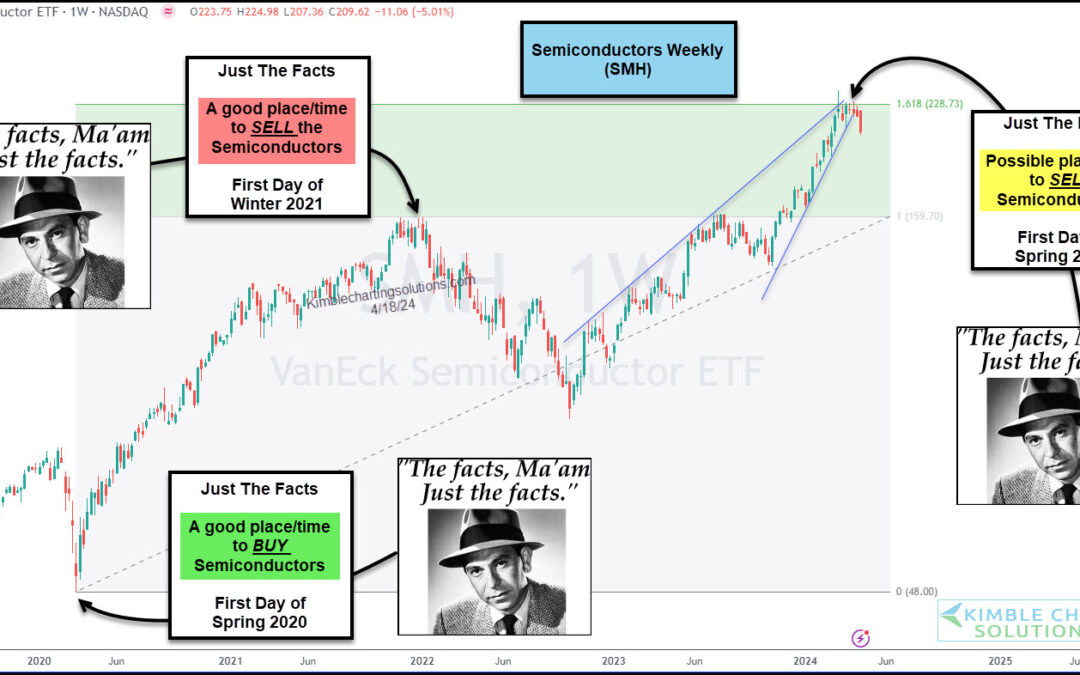

by Chris Kimble | Jul 15, 2024 | Kimble Charting

Technology stocks have been a bona fide leader, repelling sell off attempts and pushing higher. Same goes for the undisputed king of technology, the Semiconductors Sector (SMH). BUT, we are at a critical crossroads for SMH (and the broader market!). “The facts, Ma’am....

by Chris Kimble | Jun 25, 2024 | Kimble Charting

The stock market has been on an incredible run. As we have pointed out several times, the bull market’s run higher has been led by technology stocks, more precisely, semiconductor stocks. So, with the stock market indices taking a pause, it makes sense to...

by Chris Kimble | Apr 19, 2024 | Kimble Charting

We often talk about leadership. Stocks that are leading the market higher. Sectors that are leading the market higher. Indices that are leading the market higher. Why? Because it pays to be invested in leadership when the market is on the way up. And one can avoid...

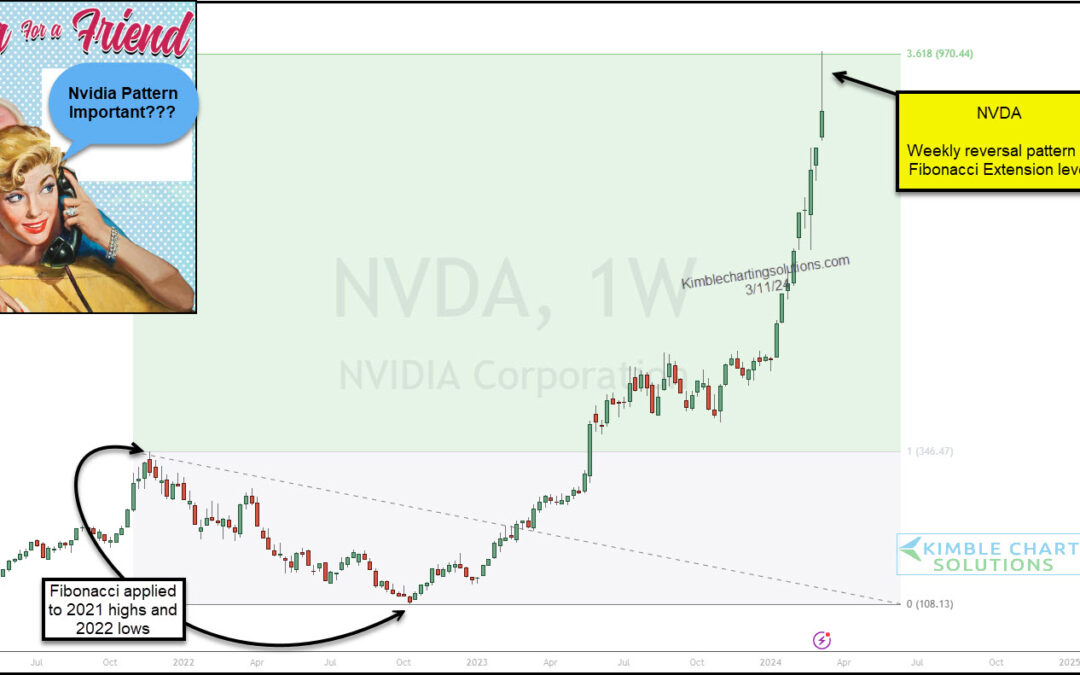

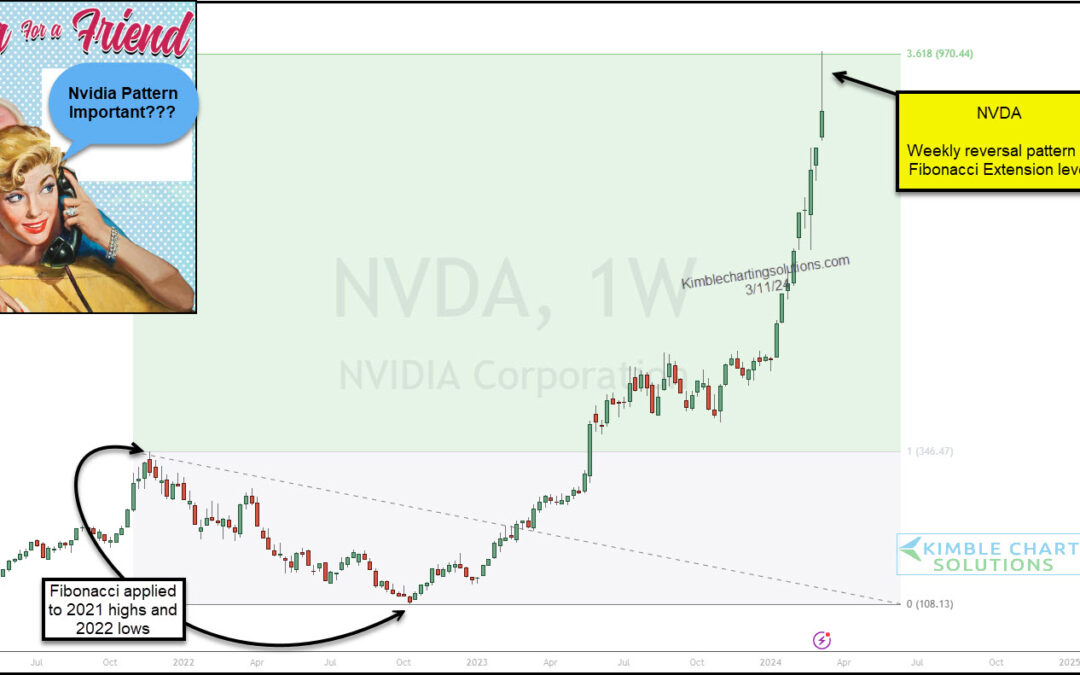

by Chris Kimble | Mar 13, 2024 | Kimble Charting

Nvidia’s stock price surged last week, reaching an important Fibonacci extension level (361.8). The rally has been unprecedented. Nvidia (NVDA) is a large cap tech stock and its price has doubled in just 9 weeks! But something happened last week. Nvidia’s formed a...

by Chris Kimble | Feb 27, 2024 | Kimble Charting

Investors have been treated to one heck of a rally by the Semiconductor Sector (SMH) with stocks like Nvidia (NVDA) leading the sector and stock market higher. But the semiconductor sector may be nearing a crossroads. Is it breakout time or break time for the red-hot...

by Chris Kimble | Feb 16, 2024 | Kimble Charting

Cisco (CSCO) used to be one of the four horsemen of the Nasdaq (tech stocks) rally. While CSCO still has plenty of influence as a large-cap leader in the Semiconductor Sector, it is under-performing its peers and trading in a pennant pattern. In short, Cisco has...

by Chris Kimble | Feb 1, 2024 | Kimble Charting

Semiconductor stocks have been leading technology stocks higher. And today’s Semi stock has been red hot: Advanced Micro Devices (AMD) As you can see on the “monthly” chart below, AMD has been ripping higher in recent months. But it’s important to note the shaded...

by Chris Kimble | Dec 14, 2023 | Kimble Charting

As I often point out, technology stocks have been the leader of bull market since 2009. And it’s always a good idea to keep a good eye on leadership. Within the technology sector, the Semiconductors are an area that is often out-performing. Today, we highlight why...