Gold Miners (GDX) Facing 13-Year Resistance!!!

Gold prices have moved steadily higher and this has provided a strong tailwind to gold mining stocks. Today, we’ll highlight a very bullish setup in this sector by looking at the Gold Miners ETF (GDX). The chart below is a long-term “monthly” chart that highlights a...

Important Gold Indicator Experiencing Multi-Year Breakout!

2024 has been filled with headlines about stock market highs and stocks such as Nvidia. But one major asset and commodity that is making an historic rally is Gold. This comes after a long, boring sideways move with a lot of ups and downs… so it’s understandable why...

Silver Bull Market Starting? Watch This Rare Bullish Signal!

When we discuss bull markets and areas of leadership, we usually point to out-performance. We’ve been writing a lot about precious metals lately, and today we look at Silver. Two things we love to see: Silver out-performing Gold (sign of risk-on), and precious metals...

Silver Breakout May Lead to Historic Price Rally Says Joe Friday!

Precious metals have been very strong over the past two years, with Gold breaking out of a historic bullish pattern. Is it time for Silver to do the same? Silver has rallied sharply but is facing heavy resistance. Let’s look at the chart! “The facts, Ma’am. Just the...

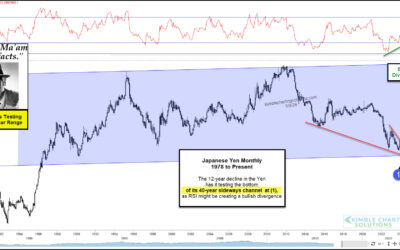

Will Japanese Yen Currency Rally From 40-Year Support?

The Japanese Yen has tumbled to new multi-decade lows after its recent free fall. Currently, the Yen is trading into 40-year support. Could this be the time/price area from which we see a rally? Let’s take a look at the chart… “The facts, Ma’am. Just the facts.” – Joe...

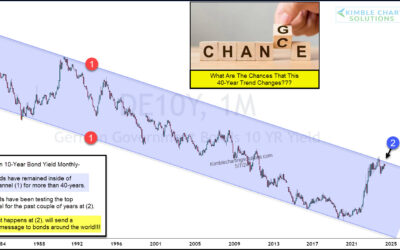

Is German 10-Year Bond Yield Nearing Historic Breakout?

Government bond yields and interest rates have been rising all around the world. And investors aren’t quite sure what to make of it. Perhaps there is some complacency that has set in after years of falling yields / interest rates. BUT, today’s chart highlights why...

Silver Rally Testing Major Breakout Resistance!

Precious metals have enjoyed a huge rally that has seen gold reach new all-time highs and silver reach new multi-year highs. There are a lot of tailwinds working for gold and silver today… global warfare, geopolitical instability, and inflation. Today we look at a...

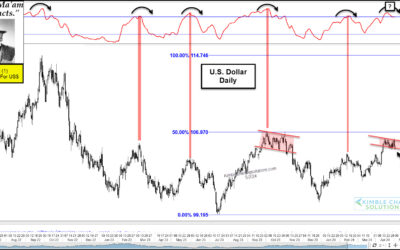

U.S. Dollar Peaking… As Momentum Indicator Reaches Historic High!

The U.S. Dollar is a key variable in all aspects of the marketplace. The strength of the dollar factors into the price we pay for food, gas, and everyday groceries. It also affects the equity and bond markets as investors factor in the risks of a dollar that is too...

Cocoa Prices Surge Higher Into Important Resistance!

Cocoa futures prices have rallied sharply over the past year. And the rally has really heated up over the past 3 months. Today we look at a “monthly” chart of Cocoa to highlight this rare and sharp rally. As you can see, hot Cocoa has gained 100% quickly after...

Is Agriculture ETF (DBA) Ready To Break Out And Send Bearish Message To Bonds?

To be successful, active investors have to watch (and create) indicators that the mainstream media do not follow. Trading is hard, requiring discipline and a strict set of rules. Today, we look at a unique set of sectors and their binary price action: “Monthly” charts...