by Chris Kimble | Dec 15, 2023 | Kimble Charting

Investors are getting excited about the Federal Reserve’s interest rate pause and a soft landing for the economy. Time will tell, but I do want to share with you a correlation that may be telling for the future of interest rates… and perhaps precious metals. Today we...

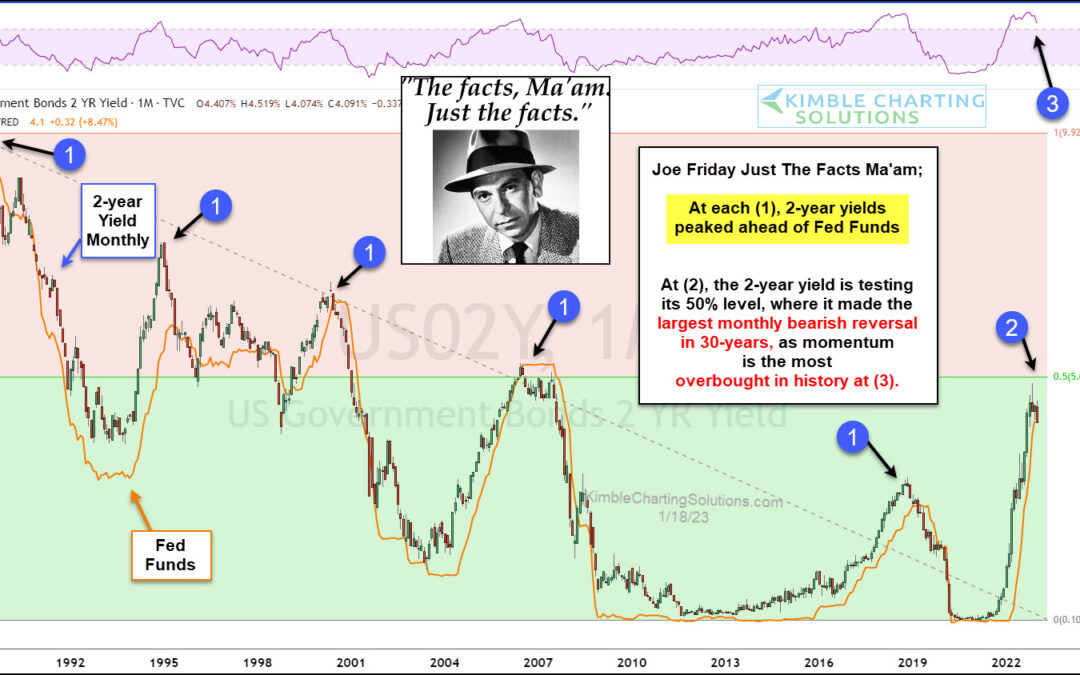

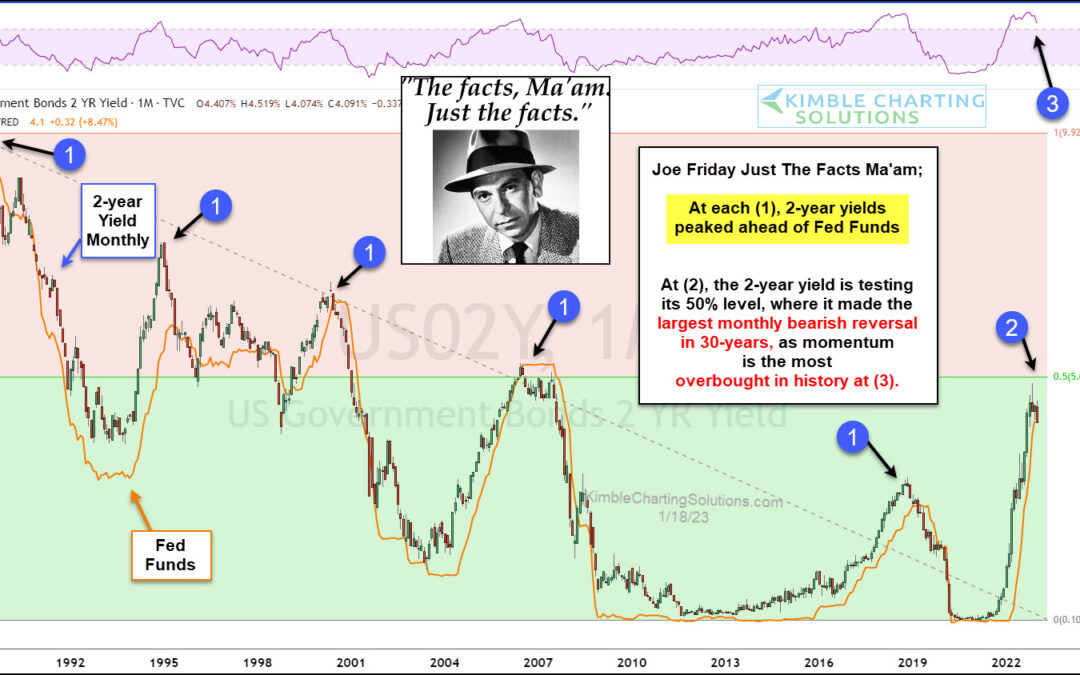

by Chris Kimble | Jan 20, 2023 | Kimble Charting

In 2022, investors watched the Federal Reserve hike interest rates very quickly. And this in turn saw bond yields move much higher. Now in 2023, bond yields are beginning to moderate and pull back. We discussed why the odds favored a pullback on 10-year bond yields...

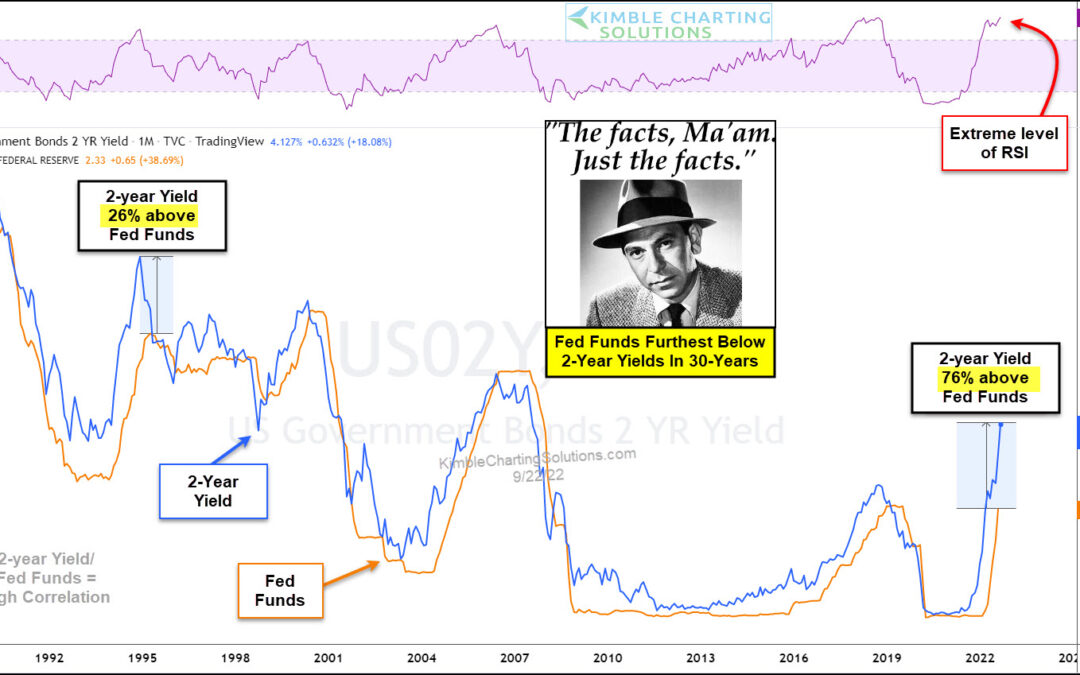

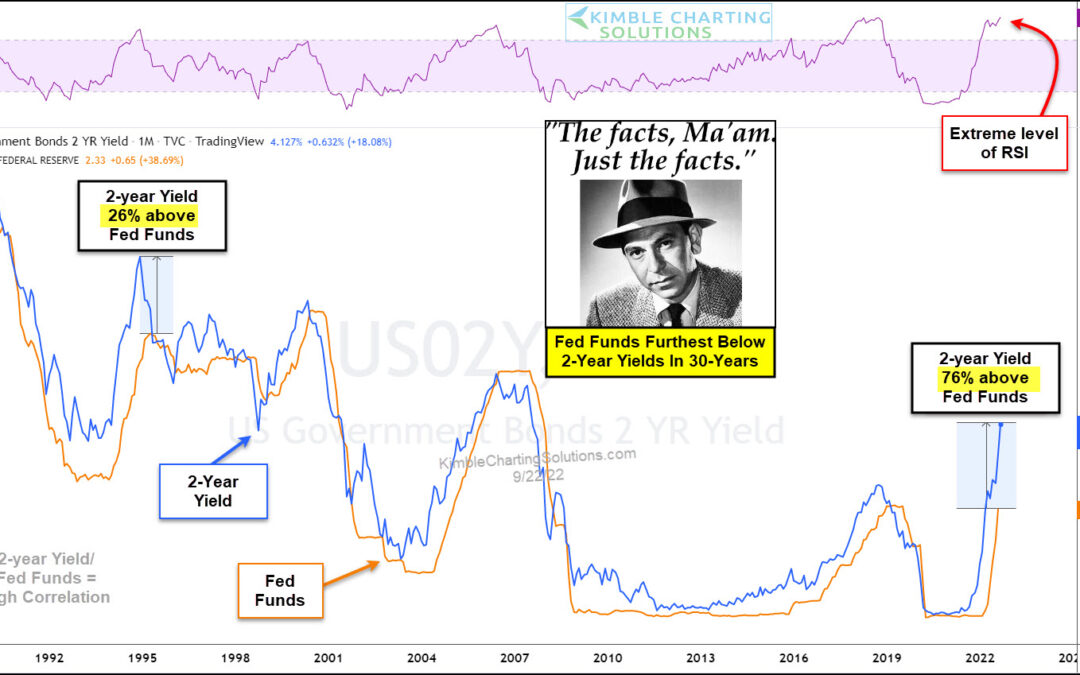

by Chris Kimble | Sep 23, 2022 | Kimble Charting

One major theme of 2022 is the Federal Reserve raising interest rates to squash inflation. Case in point, the Fed raised rates another 75 basis points on Wednesday. Will this be enough? What’s to come of interest rates? This brings us to today’s chart where we compare...

by Chris Kimble | Sep 17, 2015 | Kimble Charting, Sector / Commodity

For some reason, many around the world might be watching interest rates a little closer today, due to the Fed announcement this afternoon. Regardless of what the Fed does this afternoon, how do you make decisions in regards to rates and bond prices. Should you base...

by Chris Kimble | Dec 23, 2014 | Kimble Charting

CLICK ON CHART TO ENLARGE Is it possible for short-term interest rates to double in a couple of months? Well they have! Going back to last week, Joe Friday shared that interest rates could rise sharply, as the 10-year yield was on support and rates have just...

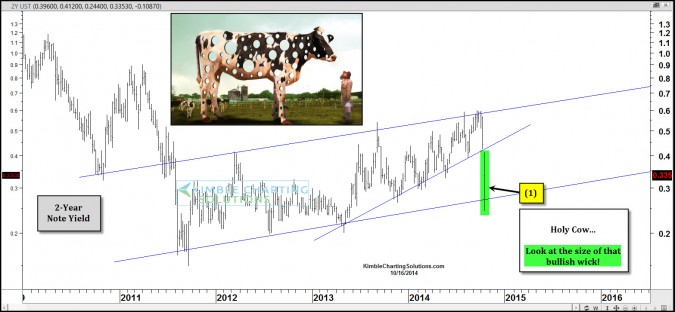

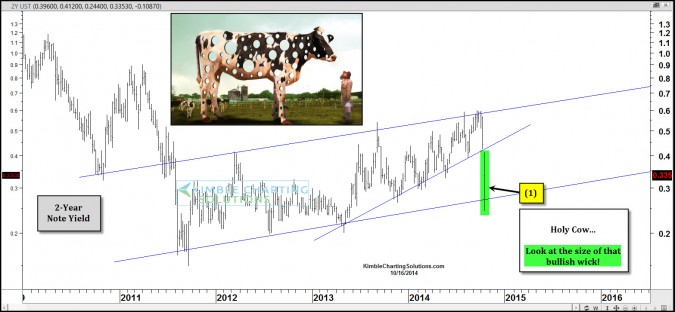

by Chris Kimble | Oct 16, 2014 | Kimble Charting

CLICK ON CHART TO ENLARGE Check out the size of that bullish wick at (1)! Holy Cow!!! The yield on the 2-year note hit support yesterday and created a huge bullish wick!

by Chris Kimble | Sep 10, 2014 | Kimble Charting

CLICK ON CHART TO ENLARGE When one looks at the yields on very short term U.S. Government debt, yields on the 2 & 5-year notes are up a big percentage over the past three years. Since 2011, the yield on the 2-year note is up over 200% (.17% to .56%) and the...