by Chris Kimble | Dec 6, 2016 | Kimble Charting

Interest rates have shot up since this past July. Have they “stretched too far too fast?” One way to measure if an asset has made a rare/extreme short-term move, is too see how far above or below its 200 day moving average, it is. Below looks at the yield...

by Chris Kimble | Sep 9, 2015 | Global Dashboard, Kimble Charting

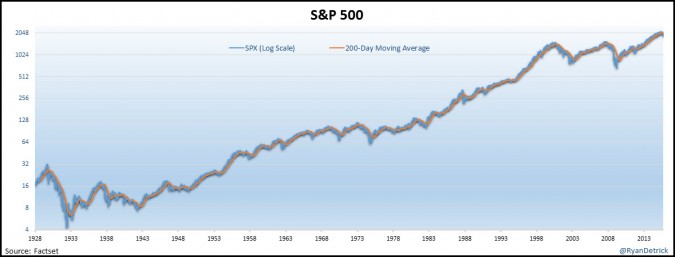

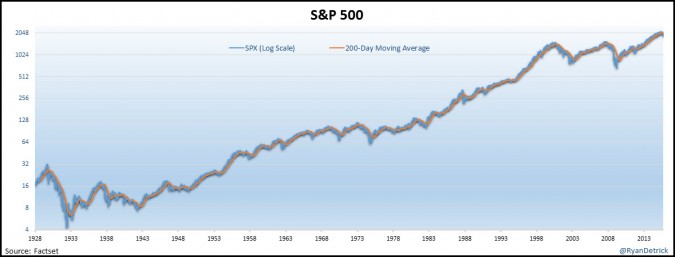

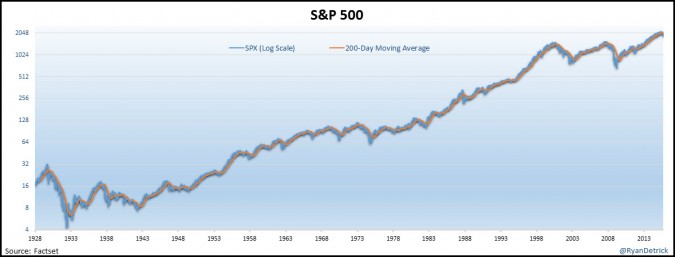

Today’s post is from my good friend Ryan Detrick. He had some unique thoughts and stats on the 200-day moving average, Thank You Ryan for your contributions! We hear a lot about the S&P 500 and its 200-day moving average. It is trading above or below...